|

As pointed out by Shiller (“Irrational Exuberance”, 2000), equity risk premia won’t always be positive. However, that is only a straw man; nobody actually claims that.

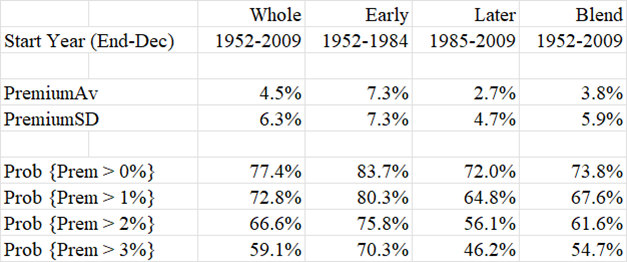

For risk premia alone, four sets of random numbers are used, representing the periods of 15 years (start year shown) for “whole” (1952-2009), “early” (1952-1984), “later” (1985-2009) and “blend” (1952-2009, 20% chance of being in 1952-1984 and 80% chance of being in 1985-2009). During 1985-2009, equity returns were considerably lower than during 1952-1984, materially affecting the risk premia.

For periods of 15 years, the table below shows the equity risk premia, assuming that all of the capital growth observed would have been achieved. The risk premium would be negative 26.2% of the time for 1952-2009 (“blend”). Taking the blend column (80% chance of being in the later period), the risk premium (% pa) would be higher than 1% 67.6% of the time, higher than 2% 61.6% of the time and higher than 3% 54.7% of the time. So long as one has the time, these seem pretty good odds.

|